This spring brought the annual wave of prospective students to colleges nationwide, with young people and their parents eager to learn about majors and campus life. Unfortunately, the most important issue of all — thecost of college — was too often omitted from those conversations.

Confusion about what a college education will cost any given family is creating a disheartening landscape, especially for working- and middle-class families who may not have been made aware of how much financial aid they could be eligible for. This challenge is compounded by renewed efforts from the Trump administration to tax endowments and cut research funding, restricting revenue sources that help make college more affordable.

Headlines often spotlight $100,000 sticker prices at elite private colleges. But even flagship public universities are increasingly — and understandably — seen as financially out of reach. “Everyone I went to high school with either went to Tech or UFS,” one rural Arkansas student told a researcher, referring to Arkansas Tech University and the University of Arkansas at Fort Smith. “Nobody really went to Fayetteville because they thought, ‘I can’t afford that. I’m not uppity.’”

For many families, the actual price of a college education remains unclear, buried beneath complex formulas and inconsistent messaging. As doubts about affordability grow, so too does the sense that the lofty promise of President Lyndon B. Johnson’s 1965 Higher Education Act — to make college broadly accessible through meaningful financial aid — has fallen short.

A 2025 survey by the Lumina Foundation, which is focused on accessibility in higher education, in partnership with Gallup, found that a mere 18 percent of Americans without a college degree believe four-year college tuition is “fair.” Nearly a third of Americans think college “isn’t worth the cost,” and another 47 percent believe it is worth the cost only if a student does not need any loans, according to the Pew Research Center.

This growing skepticism is reshaping where — and whether — students apply and enroll, and it underscores the urgent need for action. Thankfully, some progress is already underway. In recent decades, many universities have expanded need-based aid, determined by household income and family assets, to all admitted students. Still, these efforts are often overshadowed by the universities’ high sticker prices.

Most colleges offer cost calculators to help students and families estimate their aid package. But they are often confusing and ask for detailed financial information that many parents — let alone 17-year-olds — don’t have on hand. And because colleges use different calculators, trying to compare schools quickly turns time-consuming.

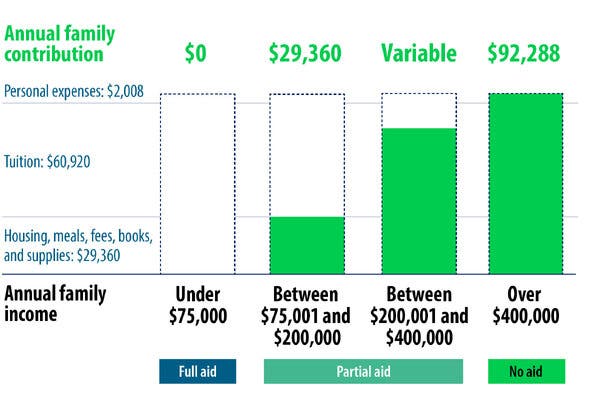

As part of our ongoing effort to clarify and improve public understanding of higher education, we created a graphic — a template any college can use — that more accurately reflects the true cost of attending the University of Pennsylvania. It illustrates that the widely cited $100,000 sticker price is not what most students will ultimately pay.

A template from the University of Pennsylvania: Colleges should display similar visuals to clearly communicate estimated costs to prospective students and families.Credit…Penn Washington University Affordability Working Group

At some of the nation’s most selective and high-cost institutions — including the University of Pennsylvania — students from families earning $75,000 or less annually often pay nothing at all. Financial aid packages comprised entirely of grants cover not only tuition but also room, board, books, fees, essential supplies such as a computer and travel expenses.

While eligibility thresholds and cost calculations vary by school, elite colleges including Harvard, M.I.T., Princeton, Dartmouth and the University of Chicago offer similar levels of support to low- and middle-income families. For middle-income families — those earning between $75,000 and $200,000 per year, typically with additional consideration for those with multiple children in college at the same time — not only is college tuition frequently fully paid for, but students often receive additional aid. As a result, these families can access some of the most selective colleges at a significant discount — at least 66 percent off full sticker price at Penn, a representative example.

Large university endowments often draw criticism, but they play a crucial role in expanding access to higher education. Endowment returns are used to cover faculty salaries and other expenses. But a 2024 study by NACUBO-Commonfund Study of Endowments, that analyzes college endowment performance and spending, showed that nearly half of the money earned from endowment returns went to financial aid. At schools with total annual costs nearing $92,000, it takes roughly $2 million in endowed funds for the return to fully support just one student.

It is true that between 2006 and 2024 average in-state tuition and fees have risen from $9,040 to $11,610, but when you factor in grant aid (excluding loans) fees have dropped from $3,940 to $2,480, according to a College Board study. Even though students still face costs for housing, food and books, they are paying less for their education today than they did two decades ago. The trend holds true at community colleges as well. In 35 states, tuition at two-year institutions is now free for many low-income students, and overall tuition costs at community colleges have declined.

But just as progress is being made — not only in expanding financial aid but improving transparency around who qualifies for it — the Trump administration now threatens to reverse that momentum. Deep cuts to federal research funding could force universities to scale back budgets, eliminate undergraduate programs and reduce financial aid.

In addition, efforts to restrict international enrollment risk slashing tuition revenue — losses that institutions may offset by raising costs for domestic students. And now, Republican lawmakers are pushing to expand the endowment tax and increase its rate — a move that may sound like accountability, but in reality would penalize students in need of support.

At Penn, the existing $10 million endowment tax already diverts an amount that could fully cover tuition and expenses for roughly 110 low-income students. Current proposals would raise that tax tenfold, potentially shutting out more than 1,100 students. Is that really the direction we want to go in — making it harder for talented students to access the opportunities they’ve earned?

A high-quality education isn’t only for the wealthiest Americans. It can be for everyone — if we commit to providing robust financial aid, clearly communicating real costs and protecting institutional resources like endowments that are meant to open doors, not be taxed shut.

Ezekiel J. Emanuel is a physician and the vice provost for global initiatives and a professor of medical ethics and health policy at the University of Pennsylvania. Caitlin Zaloom is an associate professor of social and cultural analysis at New York University and the author of “Indebted: How Families Make College Work at Any Cost.” Julian E. Zelizer is a professor of history and public affairs at Princeton University. He is the author of, most recently, “In Defense of Partisanship.”

Source photograph by ranplett/Getty Images

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips. And here’s our email: letters@nytimes.com.

Follow the New York Times Opinion section on Facebook, Instagram, TikTok, Bluesky, WhatsApp and Threads.