Companies in the “buy now, pay later” business have one message for consumers and a very different one for Wall Street and retailers. They tell consumers that B.N.P.L. is a safe, responsible way to shop. Meanwhile, they tell investors and retailers that B.N.P.L. is a good way to get people to spend more. Can both things be true? I’m not sure.

“Buy now, pay later” is making an impact this holiday shopping season. From 2019 until last year, the dollar volume of loans originated in the United States by the big five B.N.P.L. lenders grew to $24 billion from $2 billion, according to the Consumer Financial Protection Bureau. And most indications are that the strong growth has continued this year. According to a

Trending News

Editor's Picks

D.N.C. Takes Step to Void Election of Hogg and Kenyatta as Vice Chairs

David Hogg has faced sharp criticism for his plan to fund challenges to incumbent Democrats, but a D.N.C. vote on Monday began with an earlier complaint about the procedures used in an internal party election.

Yankees’ Oswaldo Cabrera taken off field by ambulance with ankle injury after scoring run

Cabrera suffered the injury while running home from third base after tagging up on Aaron Judge's bases-loaded fly ball.

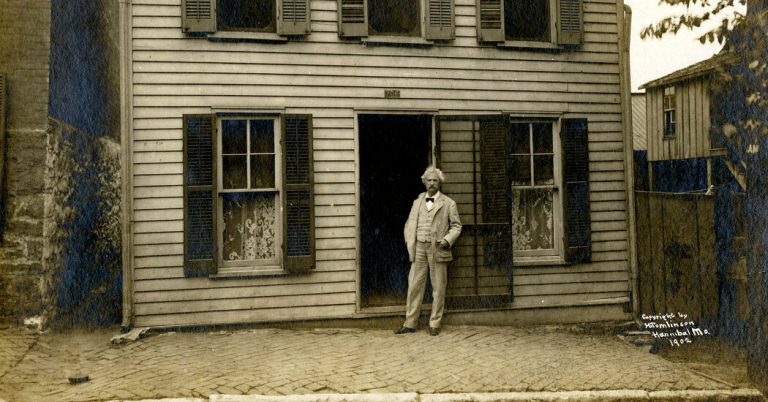

A New Biography of Mark Twain Doesn’t Have Much of What Made Him Great

Ron Chernow traces the life of a profound, unpredictable and irascibly witty writer.

These 4 People Had Never Met. Now They’re on a Road Trip to Find Dad.

In Kevin Wilson’s novel “Run for the Hills,” half siblings drive cross-country searching for the father who abandoned them.

Putin’s Shadow Armies Have Set Their Sights Beyond Ukraine

As President Trump pushes to end the Russian invasion, two books look at the paramilitary Wagner Group and consider the shape of global conflict today.